Midway through 2025, the tariff landscape has shifted from uncertainty to execution. For many manufacturers, […]

INSIGHTS

News & Resources

Tariffs Challenges Clipping Wings of Aerospace Industry

As we navigate through 2025, the aerospace sector faces significant changes due to recent tariff implementations and evolving trade agreements. On April 5, the U.S. enacted a 10% universal tariff on imports from nearly all countries, affecting various goods, including aerospace components. Additionally, a bilateral agreement established a tariff-free regime for U.K. civil aircraft and components starting June 30. As of July 27, a new zero-for-zero agreement has come into effect, exempting aerospace products traded between the U.S. and European Union from tariffs.

U.S. Tariffs on Aerospace Goods Enacted and Expanding

The recent 10% universal tariff, imposed via executive order, has broad implications for the aerospace industry, despite not being specifically targeted at it. An investigation launched in May aims to assess the potential impact of additional tariffs on aerospace goods, though no new tariffs have been finalized as of now.

However, tensions continue to simmer in global aerospace trade.

- Global Aerospace Trade Tensions Escalate: A proposed 50% tariff on Brazilian aerospace exports, specifically targeting Embraer, has been mitigated back to the baseline 10%. This adjustment alleviates some immediate pressures on the supply chain but underscores the volatility of trade relationships in the sector.

- Tariffs on Core Materials Threaten Supply Chain Stability: In June, the U.S. increased Section 232 tariffs on steel, aluminum and specialty metals to 50%. These materials are crucial for aerospace manufacturing, particularly for aircraft structure and engine production. The review of tariffs on high-performance alloys, such as titanium and nickel, further amplifies concerns about supply-chain stability. The implications of these tariffs could disrupt not just production timelines but also the cost structures of various aerospace manufacturers.

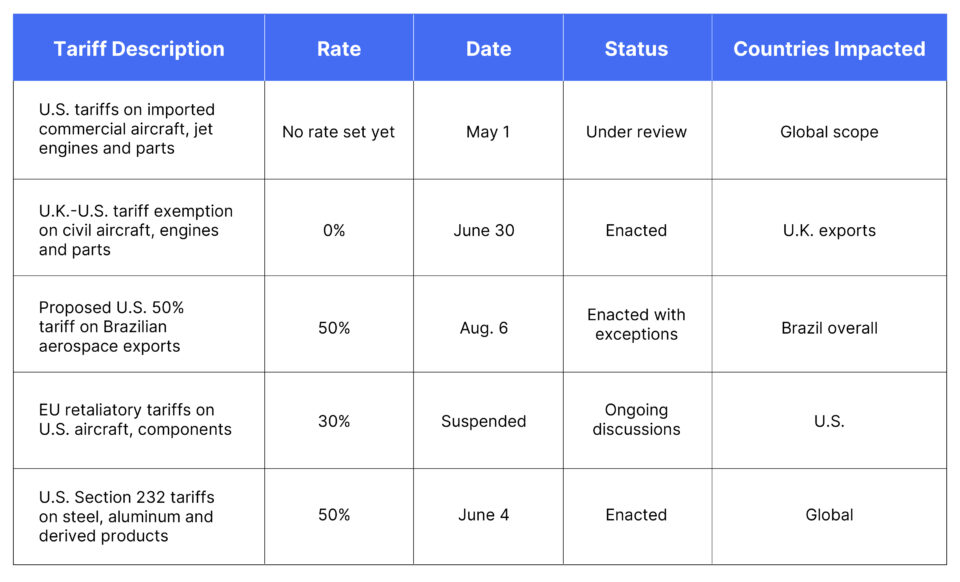

Top 5 Tariffs Expected for the Aerospace Industry

OEM and Supplier Response Roundup

Major aerospace manufacturers are adapting their strategies in response to the evolving tariff landscape. Boeing CFO Brian West has expressed optimism, noting that the company sources a significant portion of its raw materials domestically, which mitigates some tariff impacts.

- Boeing has also stockpiled inventory purchased before the tariff implementation, allowing continued production without immediate cost increases. The company is prioritizing deliveries to domestic customers, strategically reassigning aircraft originally intended for international markets facing tariff threats.

- Airbus has taken a more vocal stance, with CEO Guillaume Faury urging for a return to tariff-free trade. The company is actively exploring operational adjustments to limit its exposure to tariffs, including leveraging U.S. assembly lines and alternative delivery routes. Airbus has evaluated mitigations including prioritizing non-U.S. customers when necessary, leveraging U.S. assembly lines and alternate delivery/registration routing to limit tariff exposure. Airbus has said it will not absorb tariffs for U.S. customers.

- Delta Airlines has adopted a policy of deferring deliveries on affected Airbus aircraft, refusing to absorb additional costs linked to tariffs. Delta has largely followed through on its stated stance — deferring or rerouting affected deliveries and using legal/operational measures to avoid paying tariffs — while continuing to monitor policy developments and negotiate with manufacturers.

In response to increased tariffs and reevaluation under U.S. Section 232 measures, airlines pressured the U.S. Commerce Department to maintain the duty-free regime under the 1979 Civil Aircraft Agreement. Citing long lead times, safety certifications and costly delays.

Suppliers Feeling the Strain

- Howmet is signaling intent to suspend shipments of engine parts to Boeing and Airbus rather than sell at a loss under new tariffs.Howmet’s move reverberated through OEM supply chains — airframers and engine makers watching closely due to the high specialization of its components. Rather than suspending shipments, Howmet instead raised prices and remained operational.

- RTX flagged a potential $850 million exposure and continues to quantify the effects in quarterly results.The company is pursuing tariff exclusions/exemptions where available, implementing operational efficiencies, selective price increases and supply-chain adjustments, and expanding its U.S. operations.

- GE Aerospace plans to remedy the tariff impact by streamlining operations through the expansion of foreign trade zones, leveraging existing programs and strategies, implementing price hikes to maintain R&D efforts, and reducing operating costs by reducing nonoperational expenses. GE Aerospace announced plans in March to spend$1 billion on its U.S. manufacturing and supply chain and more than $80 million in Europe.

Insights and Predictions

As the tariff landscape continues to evolve, production pauses are expected as suppliers reassess their strategies in light of ongoing tariff pressures, likely leading to temporary layoffs. Where necessary and capable, domestic sourcing is expected to rise significantly in the coming months while tariffs are still in effect. In addition, automation investment is on the rise to combat increased labor and material costs.

From a forward-looking perspective grounded in operations and supply chain logic, some likely scenarios include:

- Supply Chain Negotiations Leading to Operational Disruptions: Tier 1-4 suppliers will need to negotiate who is responsible for footing the tariff price increases absorbed from the suppliers in each step of the process. The resulting Tier 1 and OEM negotiations mean additional costs will likely fall on the consumer.

- Supply Chain Reconfiguration: Suppliers and OEMs are expected to shift production to less-tariffed production facilities to diversify risk and reduce costs.

- Price Increases: As OEM, manufacturer and supplier costs are passed on to customers, price hikes are likely to be seen up to 25% in some cases.

- Short-term OEM Discounts: Similar to Ford’s automatic employee discounts, OEMs that do not want to force customers to foot the bill for the increased supply costs due to tariffs will likely offer incentives or discounts to reduce costs closer to normal for consumers.

How Spectrum Can Help

Staying informed and prepared is crucial for all players in the aerospace industry. Proactive strategies and adaptability will be key to mitigating risks and seizing emerging opportunities in this rapidly changing landscape.

Spectrum Management Solutions is ready to assist companies in weathering the storm of uncertainty to stay ahead of the current situation:

- Helping navigate high-level planning.

- Keeping track of the current situation and deciding what is here to stay long-term.

- Getting parts, processes, manufacturing capabilities, staffing and the moving of the supply chain to accommodate the long-term needs.

- Assisting in launching new brown sites or green sites, including navigating shifting production needs and what kinds of products, whether parts or finished manufacturing.

- Helping with capacity planning and all the steps in the processes to bring things local to handle and launch new needs.

- Bringing things local, from human resources to quoting/purchasing new suppliers, engineering, maintenance — the whole works.

Reach out to us today to see what we can do for you: spectrummanagementsolutions.com/contact/.