As we navigate through 2025, the aerospace sector faces significant changes due to recent tariff […]

INSIGHTS

News & Resources

Tariffs Are Rising, Now What? How Manufacturers Are Bracing for Impact in 2025.

Midway through 2025, the tariff landscape has shifted from uncertainty to execution. For many manufacturers, the question is no longer “what if” but what now?” With new and reinstated tariffs rolling out across critical materials and imports — including vehicles, steel, aluminum and graphite — the ripple effects are beginning to move through global supply chains. Yet despite the headlines, the smartest manufacturers aren’t reacting, they’re preparing.

At Spectrum, we’re helping clients plan their next move with clarity. Because in today’s unpredictable landscape, scenario planning and footprint strategy aren’t optional — they’re essential.

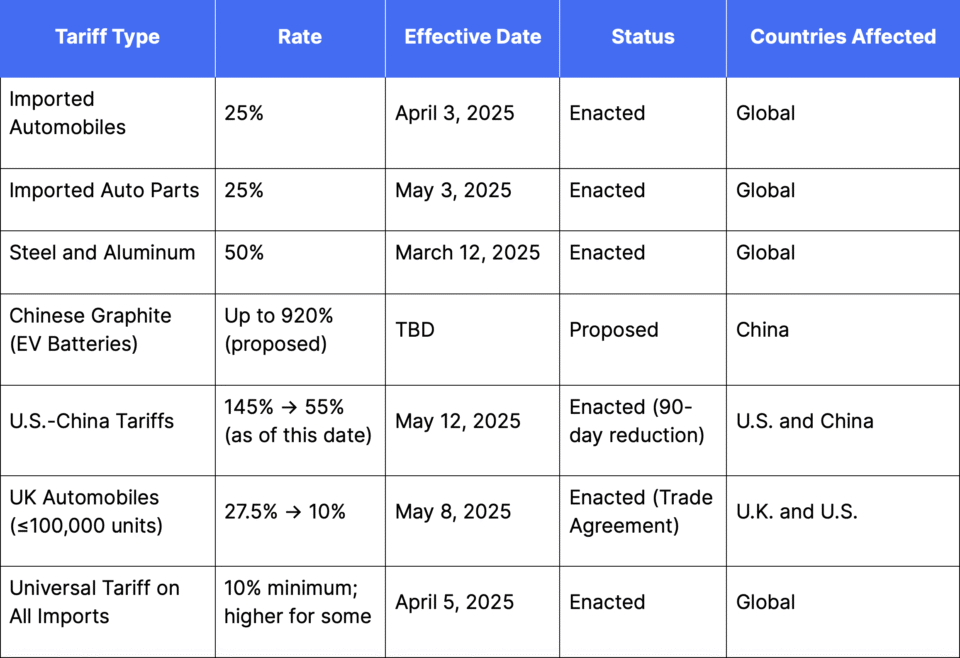

The Top Tariffs Affecting the Automotive Industry:

As of early 2025, tariffs have remained on the forefront of every industry’s mind, and it’s easy to assume these rising costs will drive up consumer prices across the board. But it may not be that straightforward.

What OEMs Are Doing

- Ford and Stellantis introduced employee pricing discounts to keep vehicles moving off lots and show commitment to the American market.

- Ford raised sticker prices by up to $2,000 on models like the Maverick and Mach-E (models manufactured in Mexico).

- GM chose to eat the cost and held pricing steady, prioritizing stability over short-term margin recovery.

- Mercedes announced moving production of the GLC SUV into the United States.

Sales data from April and May, when employee pricing discounts were active, are being closely watched to determine if these strategies are moving the needle. But beyond price shifts and incentive strategies, the most telling insight came from Ford’s Bill Ford, who recently said: “The problem we have is that the lifecycle of an automobile is longer than the political cycle.”

He’s right. The industry moves on long timelines, but the political environment changes fast. That disconnect is exactly why forward-thinking manufacturers are spending more time in the “what if” phase now, planning for scenarios before they become problems. Because when the next disruption comes, success will hinge not on how fast you react but how well you’ve prepared.

The Supplier Side: Frozen in Place

Suppliers are cautious, not reactionary. Most are focused on scenario planning, what-if modeling and unlocking excess capacity rather than committing to major operational shifts. Many are simply holding still — not out of complacency, but because the risk of overreacting is greater than the risk of waiting. The emotional whiplash of past years has left many companies gun-shy. Ruud Verstegen, sales executive EMEA at John Galt, noted that “scenario planning gives you data-driven insights. … Developments are moving too fast for you to base your decisions on guesswork.” This measured approach allows suppliers to navigate uncertainty with clarity, avoiding rash moves while staying prepared for whatever lies ahead.

Operations, Inventory and Planning Ahead

So far, production disruptions have been relatively minor. The only notable shutdown was Warren Truck, a Stellantis facility tied to poor Jeep Wagoneer sales, which ultimately was a market issue, not a tariff one. Shipment unpredictability hasn’t been a concern. But manufacturers are now beginning to rebalance inventory, especially after stockpiling in Q1 to get ahead of known cost increases. For anything considered strategic or related to national defense, that trend may continue.

As for automation, no one is making a knee-jerk move. Most companies are staying the course with their original long-term plans. Tariffs may be accelerating discussions, but they’re not changing the strategy.

5 Questions to Ask Your Ops Team

- Are We Optimizing Our Inventory Post-Stockpiling?

- Are We Prepared If Key Materials Become Harder to Source?

- Are We Stress-Testing Our Production Plans Against Cost or Supply Shocks?

- Are Our Automation Plans Still on Track?

- Are Our Teams Aligned on What’s Coming Next?

How Spectrum Is Guiding Clients

At Spectrum, we’re not just mapping what-ifs. We’re helping clients take measurable steps — reworking production footprints, repurposing idle capacity and de-risking supply chains for what’s next. That includes footprint rationalization, supply chain sensitivity testing, tool transfer feasibility and workforce planning tied to volume variability. We’re helping teams understand if new equipment can fit into existing capacity and staffing models. We’re advising on country-of-origin strategies that impact USMCA compliance and future tariff exposure. And we’re mapping out detailed ERP-integrated models to track material origin with greater accuracy.

The goal? Build a resilient structure today that’s ready to move tomorrow — before the tariffs trigger a reactive scramble.

Now’s the Time for Pre-Work, Not Panic

The landscape is changing. Some costs are going up, while others will be absorbed, spread out or engineered away. But what’s clear is this: The companies that get ahead of these shifts aren’t the ones making noise — they’re the ones quietly doing the work.

Footprint strategies. Scenario testing. ERP modeling. Workforce flexibility. These are the investments that will pay off when the next round of tariffs — or regulatory shifts, or global disruptions — inevitably arrive.

If your organization isn’t ready to move yet, that’s OK. But now is the time to prepare to move. Because once the tariffs settle, the margin for error — and time to react — shrinks fast.

If you want to hold on to your market share, you can’t afford to wait.

Progressive companies see this as an opportunity to gain it.

Need help pressure-testing your footprint before the next tariff wave?

We can help. Let’s talk.